November 2025

In recent years, the Mexican financial market has demonstrated remarkable adaptability in the face of economic disruptions, regulatory evolution, and sector-specific distress. A key area where this resilience is visible is in the country’s public and private structured finance markets where complex structures have weathered periods of significant stress – most notably during the pandemic and the subsequent distress among major non-bank lenders.

The S&P Global Ratings report, “Mexican ABS Transactions – Stress Test of Administrators,” highlighted how servicer performance and structural safeguards were tested across a series of transactions when several high-profile non-bank lenders encountered distress. The report noted that despite the financial strain and management challenges faced by these originators, the core securitization structures largely performed as intended – allowing the transition to backup servicers, protecting cash flows, and maintaining payment to investors. Significantly, S&P highlighted the important role Hilco Terracota played as master and ultimately substitute servicer for Alpha Credit in ensuring full repayment of investors in a public securitization that faced legal challenges as unsecured creditors tested the bankruptcy remote structure in Mexican courts.

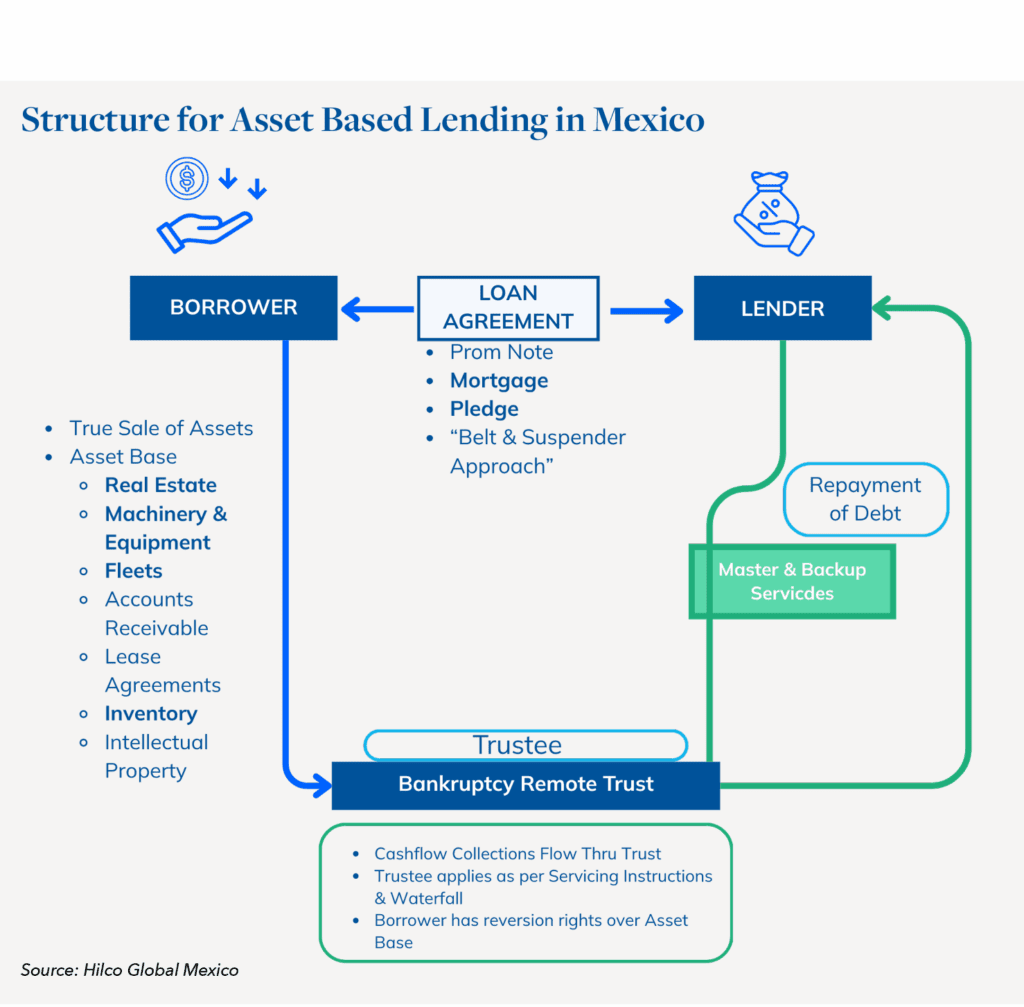

While the S&P analysis was published a few years ago and focused specifically on public asset-backed securities (ABS), transactions, it is important to emphasize that many of the same principles can be applied directly to private asset-based lending (ABL) in Mexico and are perhaps even more relevant in today’s economic climate than ever before. In both cases, the underlying goal is to build bankruptcy-remote structures that isolate cash-flow generated by the debtor´s assets, and can withstand operational or credit deterioration on the part of the borrower or originator. Lenders also need to have visibility on the performance of the debtor, the eligibility and performance of the collateral, and, ultimately, the ability to substitute the servicer for an independent professional servicer when needed, and other step-in rights. For lenders and investors operating from outside Mexico, particularly those based in the U.S., it is clear that lessons learned in the ABS sector can provide helpful insights for structuring durable, enforceable ABL facilities.

From ABS to ABL: A Shared Foundation of Structural Resilience

Securitization activity in Mexico began around 2004, expanding rapidly through 2008 and continuing until the global financial crisis exposed weaknesses in early structures. Many of those initial transactions lacked sufficient isolation of cash flows, robust master and backup servicing arrangements, and enforceable true-sale mechanics. Following the post-2009 mortgage-backed security (MBS) downturn, Mexico’s structured finance market underwent a significant period of recalibration.

By the time of the 2019–2022 stress period, the market had evolved. Modern ABS transactions incorporated higher standards of credit enhancement, better-defined waterfalls, and clearer servicing protocols, as highlighted by S&P. Notably, these transactions often featured:

- Loan-to-value (LTV) parameters aligned with realistic collateral valuations

- Dedicated cash reserves or overcollateralization mechanisms

- Waterfall provisions that prioritized senior noteholders and included accelerated amortization triggers

- Clearly designated master and backup servicers to ensure uninterrupted administration of cash flows

The resulting structures proved resilient. When originators such as Alpha Credit, Crédito Real, and Unifin experienced severe distress, the transition mechanisms to backup servicers – though imperfect – functioned well enough to sustain payments and protect investors from catastrophic loss.

These same bankruptcy-remote principles are equally applicable to asset-based lending. In fact, they can be viewed as best practices for any cross-border lending arrangement in Mexico where repayment relies on the performance or liquidation of identifiable assets, whether those assets are machinery, vehicles, equipment, receivables, or real estate.

Why ABL Structures in Mexico Require Extra Reinforcement

Most foreign lenders entering the Mexican market typically do so without local operational infrastructure. Instead, they depend on legal counsel and contractual mechanisms to protect their security interests. However, as the S&P report indirectly demonstrated, legal documentation alone is insufficient when a borrower or originator fails. Real-world enforceability hinges on how well collateral, cash flow, and servicing functions are structured and administered on the ground.

In fact, the gap between legal structure and operational execution represents one of the greatest points of vulnerability for lenders in Mexico. Without continuous oversight and an ability to transition quickly when borrowers default or servicers fail, lenders risk losing practical control of their collateral.

In Mexico, this risk is heightened by several factors including:

- Complex asset registries and varying requirements for taking title or possession

- Differences in insolvency law that can delay or complicate collateral enforcement

- Potential conflicts of interest when the originator also serves as the primary servicer

- Dependence on local custodians, trustees, and notaries to execute and authenticate asset transfers

For these reasons, the most sophisticated ABL structures in Mexico, many of which have been put in place with assistance from Hilco Global Mexico, increasingly resemble securitizations in their design – complete with trust-based bankruptcy remote structures that isolate assets, cash flows and carefully delineate servicing protocols.

Isolating Cash Flow: The Core Safeguard

A defining feature of resilient Mexican ABS transactions, and one that we strongly advocate replicating in ABL transactions, is the isolation of cash flows. The S&P analysis observed that structures with fully segregated accounts, managed through a trust (fideicomiso) arrangement, fared far better when originators faltered.

In practice, this means that all payments from underlying obligors should flow directly into trust-controlled accounts managed by a vetted trustee, rather than into the borrower’s or originator’s general operating accounts. Once in the trust, funds are disbursed according to pre-defined waterfalls that govern servicing fees, interest, principal, and reserves.

When such isolation is absent, or when account control is incomplete, the entire structure becomes vulnerable. Funds can be commingled, diverted, or delayed, especially if the borrower enters financial distress. Lenders and investors may then find themselves competing with other creditors, undermining the intended security of their asset-based facility.

The fideicomiso or trust based structure, when properly established and governed, provides a court tested, powerful safeguard against these risks. It serves not only as a legal firewall but also as a practical administrative platform for continuous monitoring and control of cash inflows.

The Role of Servicers, Trustees, and Local Partners

S&P also underscored the crucial role of administrators and backup servicers in maintaining stability when originators failed. In Mexico’s ABS market, several major defaults tested this feature. The transitions, though operationally complex, demonstrated that having a qualified, pre-designated backup servicer was essential to preserving value.

The same logic applies directly to ABL. A master servicer must ensure day-to-day management of payments, collections, and reporting, but a backup servicer – ready to assume control in the event of distress – acts as the true guarantor of continuity. Without such a mechanism, a single point of failure can jeopardize the entire transaction.

Equally important is the selection of the trustee. The trustee not only holds title to the assets but also enforces the cash flow waterfall and monitors compliance with the structure’s covenants. To function effectively, the trustee must be independent, thoroughly vetted by a knowledgeable source with a thorough understanding of, and expertise in, the market and be experienced in handling distressed asset scenarios.

Beyond legal and administrative roles, such local operational expertise can add an additional irreplaceable layer of protection. Lenders benefit significantly from partnering with firms in Mexico, such as Hilco Global Mexico, that possess on-the-ground experience in:

- Asset diligence – verifying ownership, condition, and encumbrances

- Valuation – ensuring LTV ratios reflect market realities

- Monetization – managing repossession, remarketing, or liquidation when needed

- Master and Back-up Servicing – servicing accounts receivable, leases, or payment flows efficiently

- Primary Servicing – the capability and operational capability to not only provide visibility and record keeping for the lenders, but also to provide collection services and, when necessary, monetize assets or reach other settlements with debtors

Such partners bridge the gap between contractual design and real-world execution, providing continuity from origination through resolution.

Structural Features that Reinforce Resilience

The modern generation of Mexican ABS transactions provides a template for resilient ABL design. In our opinion, the following features, many of which are now standard in securitization, should be incorporated wherever possible into asset-based lending structures:

- True Sale or Traditional Mortgage/Pledge Mechanism: Assets should be transferred to a trust in a true sale transaction, or, in some cases, traditional security interests such as mortgages and non-possessory pledges can be created in a manner that prevents recharacterization risk and protects lenders in the event of borrower insolvency

- Bankruptcy-Remote Trust Structure: The use of a fideicomiso to hold assets ensures legal separation between borrower operations and collateral pools

- Cash Reserve Accounts: Establishing reserve funds within the trust provides liquidity for temporary shortfalls and supports payment continuity

- Waterfall Provisions: Clear prioritization of payments – fees, interest, principal, and reserves – reduces ambiguity during distress scenarios

- Accelerated Amortization Triggers: Predefined triggers tied to performance or covenant breaches allow for rapid deleveraging

- Master and Backup Servicers: Pre-identified servicers ensure uninterrupted administration even if the borrower or originator fails

- Ongoing Valuation and Diligence Oversight: Regular monitoring of collateral quality and market value prevents erosion of security coverage over time

Such mechanisms collectively create what we refer to as the “belt and suspenders” that experienced lenders should consider essential to ensuring successful cross-border ABL in Mexico.

Lender and Investor Best Practices

Before closing any transaction backed by Mexican assets, lenders and investors – particularly those based outside the country – should take specific steps to ensure long-term structural resilience:

- Engage a local partner early who has proven expertise across diligence, valuation, monetization, and servicing.

- Use a bankruptcy-remote trust structure (fideicomiso) to hold assets and receive all related cash flows.

- Appoint both master and backup servicers with pre-agreed transition procedures embedded in the loan documentation. Details matter in these provisions so that invoices can continue to be issued, tax payments and account statements continue, and other operational challenges flow seamlessly.

- Vet and approve a qualified trustee capable of enforcing the waterfall, managing reserves, and coordinating with the servicers.

- Implement strict cash-flow isolation, ensuring payments from obligors flow directly into trust accounts, never to the borrower.

- Define clear default and trigger events, enabling accelerated amortization or replacement of servicers when needed.

- Require regular reporting and valuation updates from local partners to maintain accurate, current insight into collateral performance.

- Rehearse or test transition mechanisms periodically, simulating a servicer failure to verify operational readiness.

The Cost of Neglect

Failing to incorporate these safeguards exposes lenders to cascading risks. Without isolated cash flows, funds may be trapped in borrower accounts during insolvency, leading to delayed or lost recovery. Without a backup servicer, collections can stall for months or years while legal disputes unfold. And without reliable local oversight, collateral values can deteriorate unnoticed, eroding recovery prospects long before lenders become aware.

Past incidents of distress among non-bank lenders such as Alpha Credit and Crédito Real provide a cautionary tale. In some cases, bondholders and lenders who relied on originator-led servicing or loosely defined trust structures faced prolonged disruptions. Those who employed well-structured, trustee-controlled frameworks with active backup servicers and local oversight, experienced smoother transitions and better recoveries.

These outcomes underscore a simple truth: structure is destiny in asset-based lending. The difference between recovery and loss often depends less on the borrower’s original credit quality and more on the practical enforceability of the lender’s structure when stress arrives.

Conclusion: From Structure to Sustainability

As global investors and U.S.-based lenders deepen their participation in Mexico’s asset-backed markets, the dividing line between securitization and ABL continues to blur. Both depend on enforceable, bankruptcy-remote mechanisms that insulate cash flows and collateral from the borrower’s balance sheet.

Mexico’s ABS market, once viewed as fragile, has matured into a field of resilient and well-tested structures. These same principles – trust-based isolation, disciplined servicing, and continuous local oversight – represent the foundation for sustainable asset-based lending in Mexico today.

For foreign lenders, the path forward should be clear: treat every ABL transaction as though it were a private securitization. Build redundancy, isolate cash flows, and ensure that capable local experts are embedded from day one. Doing so not only protects capital but also enables the kind of long-term, scalable lending that Mexico’s evolving economy both needs and rewards.

About Hilco Global Mexico

For firms with assets in Latin America, Hilco Global Mexico offers vast expertise in valuation, monetization and advisory. Hilco Terracota, an arm of Hilco Global Mexico which specializes in master, back-up and loan servicing, was the acting master servicer and was then appointed as substitute servicer during the Alpha Credit bankruptcy for a large public securitization. At a critical time for the company, its lenders and advisors, the Hilco Terracota team was able to step in with a full understanding of the many nuances of the portfolio assigned to the Trust. This allowed for both the timely identification of inconsistencies and the reconciliation of issues, paving the way for creditors to be paid with minimal delay. This consistent presence also served to reassure creditors throughout the process, reducing uncertainty and instilling confidence in an ultimately positive outcome that resulted in full, accelerated repayments to all lenders to the securitization.

For more than 20 years, Hilco Global Mexico has conducted inventory, machinery and equipment valuations, monetized a wide variety of machinery and equipment from industrial facilities, performed retail asset disposition and acquisition, executed on commercial accounts receivable portfolios, and valued, sold, and redeveloped real estate. Hilco Global Mexico’s leadership team is experienced in Latin American markets and can deliver local expertise while tapping into Hilco Global’s worldwide resources. Hilco Global, a subsidiary of ORIX Corporation USA, is a diversified financial services company that delivers integrated professional services and capital solutions that help clients maximize value and drive performance across the retail, commercial industrial, real estate, manufacturing, brand and intellectual property sectors, and more. Hilco Global provides a range of customized solutions to healthy, stressed, and distressed companies to resolve complex situations and enhance long-term enterprise value. Hilco Global works to deliver the best possible result by aligning interests with clients and providing strategic advice and, in many instances, the capital required to complete the deal.

Article by: Samuel Suchowiecky – CEO, Hilco Global Mexico. View BIO